Pricing Principles

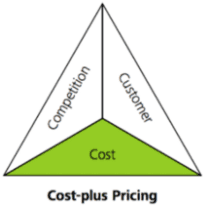

Cost-Plus Pricing

-

Material costs: $6.00

-

Labor costs: $10.00

-

Shipping costs: $5.00

-

Marketing and overhead costs: $9.00

Competitive Pricing

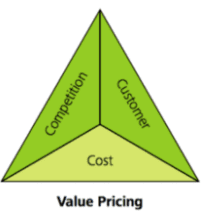

Value Pricing

-

A well-developed and properly positioned brand

-

Great products that have unique benefits and features

-

Marketing campaigns that resonate with the target audience

Price Structure

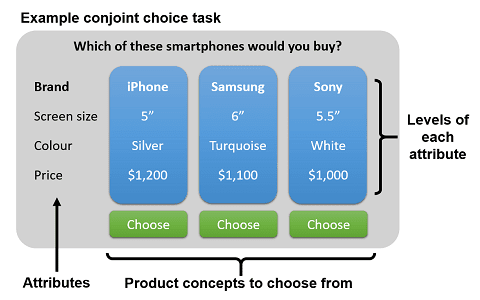

The price structure is designed to capture the most affordable price for each customer group. It is possible to optimize pricing in certain industries, such as airline companies that sell identical airplane seats with different conditions depending upon the customer's profile. It is difficult to create a segmented pricing structure that differs not only in the price but also in the offer and qualifying criteria. A few tools can help:

Bundles can be a powerful tool if you combine elements that would be more price-sensitive if they were sold individually. Bundling a low-priced service with other products can sometimes work better than simply lowering its price. Examples of this include low-cost financing, payment terms, and anything else that customers may not value as much. Bundling optional services for free is a bad idea unless the cost to deliver the service itself is very low.

Conjoint Analysis

Who Should Manage Pricing?

General management is ultimately responsible for the profitability of the enterprise, but the General Manager is usually not the person most in touch with the details that go into a proper pricing decision.

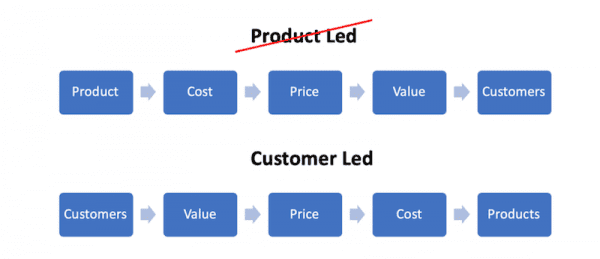

Value-Based Pricing is the most profit-maximizing strategy of all pricing strategies. To use Value-Based Pricing, the person pricing a product or service must understand the value the customer or customer segment derives from the product or service.

Also, the person must be able to understand and compare the market landscape, including the prices of competitors and their differentiating factors.

To ensure profitability, one must know how much money was spent on the product's construction.

There is only one person who understands all of these values and can put a dollar value on each of them. That is the Product Manager. Because of this level of insight, they should be responsible for pricing.

Aspiring PMs: Next time you use/purchase/see a product, question its value to you. Put a dollar value on it and verify that the return on your investment (ROI), meets your expectations. You can do the same thing with a competitor's product. Do some mental math to determine how much it would have cost to produce the product. Find out which product is right-priced and why.

The Bottom Line

Use Pricing Principles in Your Business

Asymmetric, led by former Army Delta Force operator and corporate executive, Mark Hope, can help you implement these ideas in your business. You can contact Mark by email at mark.hope@asymmetric.pro, or by telephone at +1 866-389-4746, or you can schedule a complimentary strategy discussion by clicking here. You can read all of his articles on Medium.

Mark Hope

Mark A. Hope is the founder and CEO of Asymmetric Marketing – a unique agency specializing in building high-performing sales and marketing systems, campaigns, processes, and strategies for small businesses. Asymmetric has extensive experience with organizations across many industry segments. If you would like some help in implementing ideas like these in this article, feel free to give Mark a call at 844-494-6903 or by email at mark.hope@asymmetric.pro.